In the 21st century, global trade is no longer defined by traditional commodities like oil or grain. Instead, it is shaped by the race to secure green metals — lithium, cobalt, nickel, and rare earth elements — the lifeblood of electric vehicles, renewable energy, and digital technologies. In this new era of energy diplomacy, access to and control of these resources has become as vital as controlling the old oil wells.

The New Strategic Assets

Lithium and its green metal siblings have reshaped international trade:

-

🔋 Lithium: The backbone of batteries, powering electric cars and long-duration energy storage.

-

🌱 Cobalt and Nickel: Critical for making batteries more stable and energy-dense.

-

🌐 Rare Earth Elements: The hidden engine of wind turbines, smartphones, and fighter jets.

With global electric vehicle sales rising by roughly 40% annually, these minerals are now the backbone of economic and military supremacy.

The Geopolitical Flashpoints

The global race for critical minerals has created new tensions:

-

🇨🇳 China’s Dominance: Currently refining nearly 80% of the world’s lithium and rare earth supply, making it an indispensable link in the global supply chain.

-

🇺🇸 The New Inflation Reduction Act: The U.S. aims to reduce dependency, reshaping global alliances by promoting domestic mining and recycling.

-

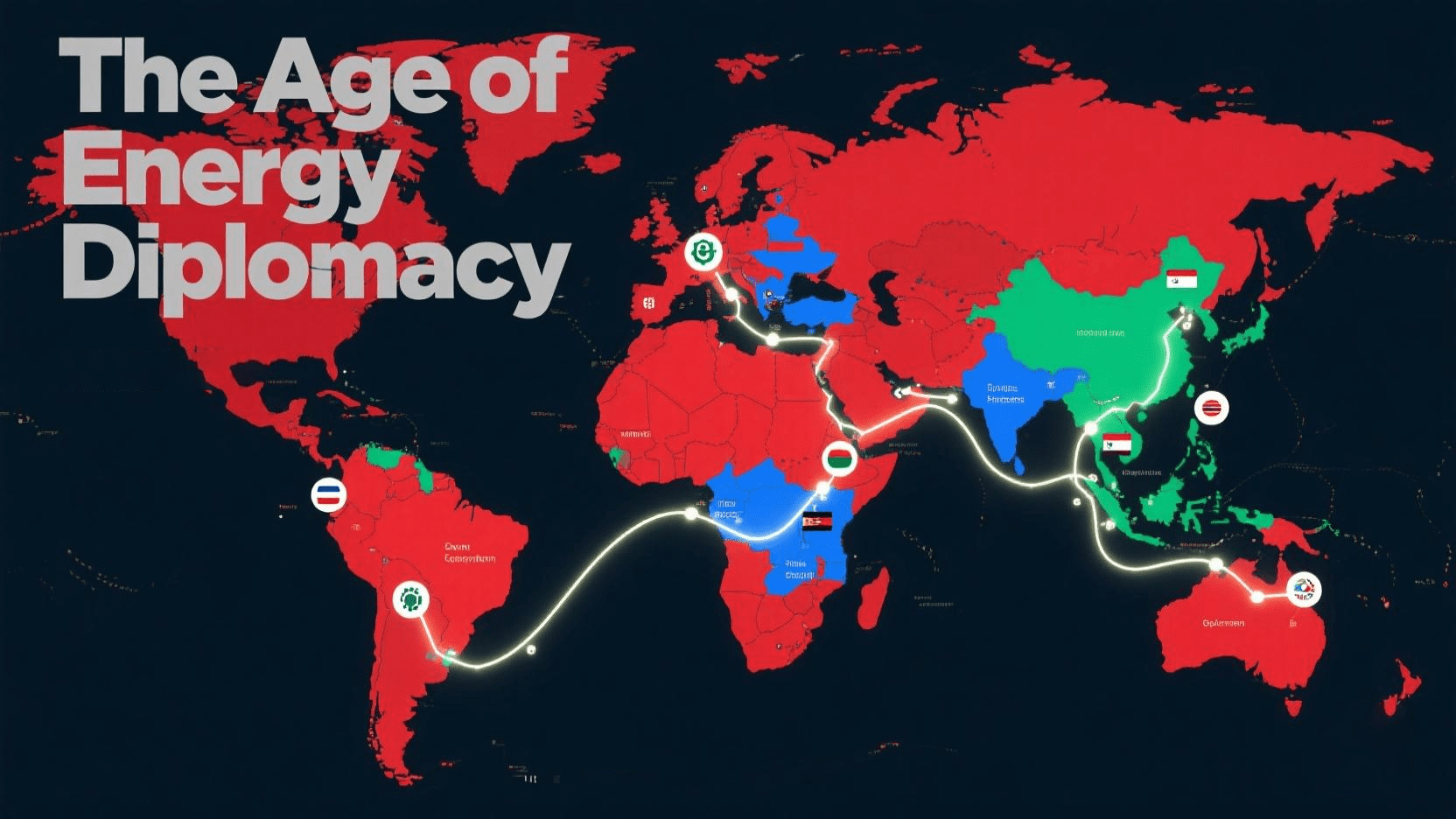

🇦🇺 🇨🇱 🇦🇷 The Lithium Triangle: South America emerges as a critical node, with Bolivia, Argentina, and Chile holding over 55% of global lithium reserves.

-

🇿🇲 🇨🇩 African Impact: The Democratic Republic of the Congo and Zambia have become contested spaces, making mineral-rich nations pivotal in global negotiations.

The Trade-Offs and Challenges

While these metals enable a green revolution, extracting and transporting them carry significant environmental and social costs:

-

⚡ Environmental Damage: Lithium extraction consumes billions of gallons of water, impacting fragile ecosystems and indigenous communities.

-

👥 Social Pressures: The rise of artisanal mining has spotlighted labor exploitation and human rights abuses.

-

🌳 Regulatory Pressures: New global ESG standards force firms to trace mineral provenance and minimize their environmental footprints.

Redesigning the Global Trade Map

Future global commerce will hinge on the control and equitable distribution of these green metals:

-

🚢 New “Lithium Sea Lanes” will connect South America, Australia, and Asia.

-

⚔️ Resource-rich nations will gain unprecedented bargaining power, reshaping traditional trade alliances.

-

🌱 Sustainable mining and recycling technologies will define the competitive edge for manufacturers and nations alike.

Final Thought:

In the era of electrification, lithium and green metals have replaced oil as the currency of global commerce. The nations, firms, and communities that secure and steward these resources wisely will define the economic and environmental future of the planet.